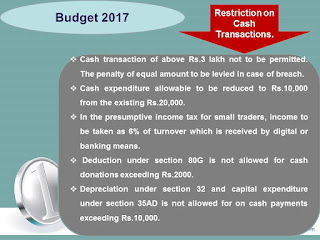

1. Cash transactions above Rs.

3 lakh not to be permitted.

Budget

2017 insert a new section 269ST, to provide that no person shall receive an

amount of three lakh rupees or more in cash –

a.

in

aggregate from a person in a day;

b.

in

respect of a single transaction; or

c.

in

respect of transactions relating to one event or occasion from a person,

The

proposed restriction shall not apply to Government, any banking company, post

office savings bank or co-operative bank.

The

above restriction shall not apply for transactions in the nature specified

under section 269SS (Mode of taking or accepting certain loans, deposits and

specified sum).

Penalty

for non-compliance

100%

penalty is proposed to be levied in case of non-compliance.

New

section 271DA is proposed to be inserted to effect the provision of penalty in

case of non-compliance under section 269ST. The said penalty shall however not

be levied if the person proves that there were good and sufficient reasons for

such contravention. It is also proposed that any such penalty shall be levied

by the Joint Commissioner.

The

provision related to tax collection at source at the rate of one per cent. of

sale consideration on cash sale of jewellery exceeding five lakh rupees is also

proposed to be omitted by amending the provisions of section 206C.

These

amendments will take effect from 1st April, 2017.

2. Cash expenditure allowable

to be reduced from Rs. 20,000 to Rs. 10,000.

Section

40A is proposed to be amend to provide the following:

i.

To

reduce the existing threshold of cash payment to a person from twenty thousand

rupees to ten thousand rupees in a single day; i.e any payment in cash above

ten thousand rupees to a person in a day, shall not be allowed as deduction in

computation of Income from "Profits and gains of business or

profession";

ii.

Deeming

a payment as profits and gains of business of profession if the expenditure is

incurred in a particular year but the cash payment is made in any subsequent

year of a sum exceeding ten thousand rupees to a person in a single day; and

iii.

Further

expand the specified mode of payment under respective sub-section of section

40A from an account payee cheque drawn on a bank or account payee bank draft to

by an account payee cheque drawn on a bank or account payee bank draft or use

of electronic clearing system through a bank account.

The

amendment will take effect from 1st April, 2018 and will,

accordingly, apply in relation to the assessment year 2018- 19 and subsequent

years.

3. In the presumptive income tax for small

traders, income to be taken as 6% of turnover which is received by digital or

banking means.

It is

proposed to amend section 44AD of the Act to reduce the existing rate of deemed

total income of eight per cent. to six per cent in respect of the amount of

such total turnover or gross receipts received by an account payee cheque or

account payee bank draft or use of electronic clearing system through a bank

account during the previous year or before the due date specified in

sub-section (1) of section 139 in respect of that previous year.

However,

the existing rate of deemed profit of 8% referred to in section 44AD of the

Act, shall continue to apply in respect of total turnover or gross receipts

received in any other mode.

This

amendment will take effect from 1st April, 2017 and will, accordingly, apply in

relation to the assessment year 2017-18 and subsequent years.

4. Restricting cash donations

Section

80G is proposed to be amend so as to provide that no deduction shall be allowed

under the section 80G in respect of donation of any sum exceeding two thousand

rupees unless such sum is paid by any mode other than cash.

Under

the existing provision, deduction under section 80G is allowed for cash payment

upto Rs. 10,000.

This

amendment will take effect from 1st April, 2018 and will, accordingly, apply in

relation to the assessment year 2018-19 and subsequent years.

5. Disallowance of

depreciation under section 32 and capital expenditure under section 35AD on

cash payment

Section

43 is proposed to be amend, to provide that where an assessee incurs any

expenditure for acquisition of any asset in respect which a payment or

aggregate of payments made to a person in a day, otherwise than by an account

payee cheque drawn on a bank or account payee bank draft or use of electronic

clearing system through a bank account, exceeds ten thousand rupees, such

expenditure shall be ignored for the purposes of determination of actual cost

of such asset.

Section

35AD (Deduction in respect of expenditure on specified business), to provide

that any expenditure in respect of which payment or aggregate of payments made

to a person in a day, otherwise than by an account payee cheque drawn on a bank

or an account payee bank draft or use of electronic clearing system through a

bank account, exceeds ten thousand rupees, no deduction shall be allowed in

respect of such expenditure.

These

amendments will take effect from 1st April, 2018 and will, accordingly, apply

in relation to the assessment year 2018-19 and subsequent years.

No comments:

Post a Comment