New Section 94B is

inserted by Budget 2017, to limit the interest that can be deducted in

computing a company’s profit for tax purposes.

It is aimed at bringing

India’s tax regime in line with the recommendations contained in action 4 of

the OECD/G20 base erosion and profit shifting (BEPS) project, which are

primarily designed to target cross –border profit shifting through excessive

interest payments and as a result, protect the tax base.

It is further proposed

that the debt is deemed to have been issued by an associated enterprise/

related parties, where the debt is issued by a lender which is not associated

but an associated enterprise either provides an implicit or explicit guarantee such

lender or deposits a corresponding matching amount of funds with the lender.

This amendment will be effective from previous year 2017-18 and apply in relation to assessment year 2018-2019 and subsequent years.

“Clause

43 of the Bill seeks to insert a new section 94B in the Income-tax Act relating

to limitation on interest deduction in certain cases.

Sub-section

(1) of the said section seeks to provide that where an Indian company, or a

permanent establishment of a foreign company in India being the borrower, pays

interest or similar consideration exceeding one crore rupees which is

deductible in computing income chargeable under the head "Profits and

gains of business or profession" in respect of any debt issued by a

non-resident, being an associated enterprise of such borrower, interest shall

not be deductible in computation of income under the said head to the extent

that it arises from excess interest, as specified in sub-section (2).

It

is further proposed to provide that where the debt issued by a lender which is

not associated but an associated enterprise either provides an implicit or

explicit guarantee such lender or deposits a corresponding and matching amount

of funds with the lender, such debt shall be deemed to have been issued by an

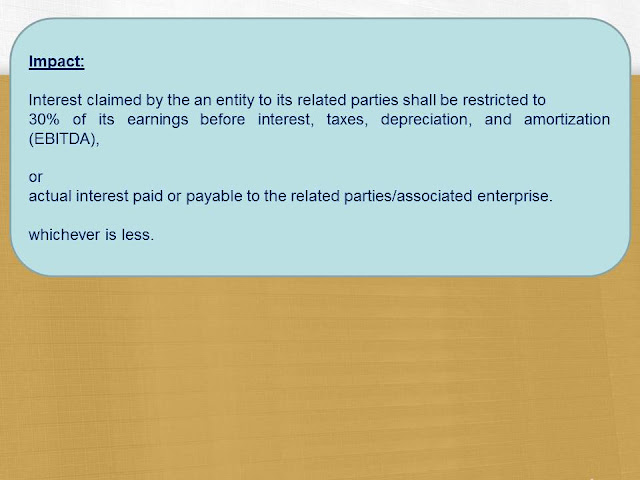

associated enterprise. Sub-section (2) of the said section seeks to provide

that for the purposes of sub-section (1), the expression "excess

interest" shall mean an amount of total interest paid or payable in excess

of thirty per cent. of earnings before interest, taxes, depreciation, and

amortisation of the borrower in the previous year or interest paid or payable

to associated enterprises for that previous year, whichever is less.

Sub-section

(3) of the said section seeks to provide that nothing contained in sub-section

(1) shall apply to an Indian company or a permanent establishment of a foreign

company which is engaged in the business of banking or insurance.

Sub-section

(4) of the said section seeks to provide that where for any assessment year,

the interest expenditure is not wholly deducted against income under the head

"Profits and gains of business or profession", so much of the

interest expenditure as has not been so deducted, shall be carried forward to

the following assessment year or assessment years, and it shall be allowed as

deduction against the profits and gains, if any, of any business or profession

carried on by him and assessable for that assessment year to the extent of

maximum allowable interest expenditure in accordance with sub-section (2). It

is further provided that no interest expenditure shall be carried forward under

this section for more than eight assessment years immediately succeeding the assessment

year for which the excess interest expenditure was first computed.

Sub-section

(5) of the said section seeks to define the expressions "associated

enterprise", "debt" and "permanent establishment".

This

amendment will take effect from 1st April, 2018 and will, accordingly, apply in

relation to the assessment year 2018-2019 and subsequent years.”

No comments:

Post a Comment