Key highlights of the bill

Ø

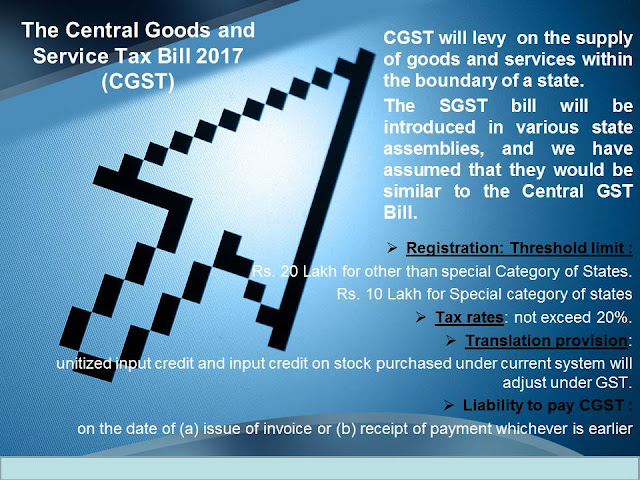

The Central Goods and Services Tax Bill, 2017 was introduced in Lok

Sabha on March 27, 2017. The Bill

provides for the levy of the Central Goods and Services Tax (CGST).

Ø

Levy of CGST :

The CGST will levy on the supply of goods and services within

the boundary of a state. Supply include

sale, transfer and lease made for a consideration to further a business.

Ø

Tax rates :

The tax rates will be

recommended by GST Council. It will not exceed 20%. Further it allows flat rate

of GST on turnover, instead on the value of supply of goods and services (under

composition levy) to certain taxpayers whose turnover is less than Rs. 50 lakh.

Ø

Exemptions from CGST

:

Certain goods may exempt

from the purview of GST through notification based on the recommendation of GST

council.

Ø

Liability to pay

CGST :

Liability to pay CGST will

arise on the date of (a) issue of invoice or (b) receipt of payment whichever

is earlier in relation to supply of goods and services.

Ø

Value of supply for levy

of CGST (Taxable value):

Taxable value of goods and

service for levy of CGST will include :

(a)

Price paid on the supply

(b)

Taxes and duties levied under a different tax law

(c)

Interest, late fee, penalties for delayed payments.

Ø

Input Tax credit

under CGST :

Every taxpayer while paying

taxes on outputs, may take credit equivalent to taxes paid on inputs. However, this will not be applicable on

supplies related to:

(a) personal consumption,

(b) supply of food, outdoor catering, health

services, etc. unless they are further used to make a supply.

Ø

Registration :

Threshold limit for mandatory

registration under GST :

Rs. 20 Lakh for other than

special Category of States.

Rs. 10 Lakh for Special

category of states*

* Arunachal Pradesh, Assam,

Jammu and Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal

Pradesh and Uttarakhand.

Ø

Returns :

Every taxpayer will require

to file return on monthly basis. In addition to monthly return taxpayer will

also require to file annual return.

Ø

Transition to the

new regime:

Taxpayers with unutilised

input tax credit obtained under the current laws such as CENVAT may utilise it

under GST. In addition, businesses may

also avail input tax credit on stock purchased before the start of

implementation of GST.

Ø

Anti-profiteering

measure:

The central government may

by law set up an authority or designate an existing authority to examine if

reduction in tax rate has resulted in commensurate reduction in prices of goods

and services. The powers of the

authority will be prescribed by the government.

Ø

Compliance rating

Every taxpayer shall be

assigned a GST compliance rating score based on his record of compliance with

the provisions of this Bill. The

compliance rating score will be updated at periodic intervals and be placed in

the public domain.

No comments:

Post a Comment