Key highlights of bill:-

Ø

The bill introduced in Lok Sabha on March 27,2017.

Ø

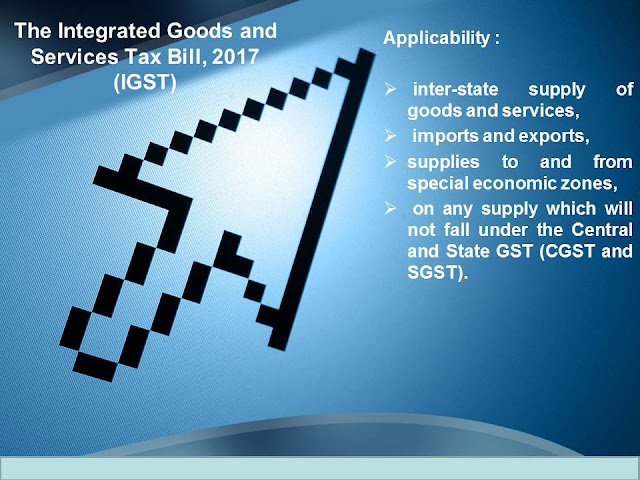

Applicability :

The IGST will levied by

centre on

(a)

inter-state supply of goods

and services,

(b)

imports and exports,

(c)

supplies to and from special

economic zones.

(d)

on any supply which will not

fall under the Central and State GST (CGST and SGST).

Supply includes sales, transfer,

exchange, and lease made for a consideration to further a business.

Ø

Tax rates :

IGST will be levied at a

rate recommended by the GST Council. The

tax rate will be capped at 40%.

Ø

Exemption from IGST:

Certain goods and services

may be exempted by centre from the preview of IGST based on the recommendation

of GST Council.

Ø

Place of supply of

goods:

Place of supply

|

||

1.

|

In case of Good has been physically moved.

|

The final destination of good.

|

2.

|

In other cases.

|

Where the goods

received by the recipient.

|

Ø

Place of supply of

services:

Place of supply of service

will depending upon the nature of service.

In case of services

provided in relation to an immovable property, place of service will be the

location at which the immovable property is located or intended to be located.(

for example services provided by architect, interior decorators, surveyors,

engineers, etc.)

Supply of services such as catering,

sporting events, transportation of goods, advertisement, telecommunications,

among others, specific provisions for determination of place of service have

also been specified under IGST.

Ø

Input Tax Credit :

Every taxpayer while paying

taxes on output may take credit for taxes paid earlier by the supplier on

inputs.

However, this will not be

applicable on supplies related to:

(a)

motor vehicles when used for personal consumption,

(b)

supply of food, health services, etc. unless they are further used

to make a supply.

Ø

Application of CGST

provisions :

In relation to

registration, valuation, time of supply of goods, returns, refunds,

prosecution, appeals the provisions of CGST will be applicable under the IGST

Act.

No comments:

Post a Comment